lhdn 2018 tax rate

Shahrir 72 is alleged to have been involved in money laundering by not reporting his actual income in the income tax return form with regard to the RM1mil which contravenes Section 1131a of. Tax Exemption On Rental Income From Residential Houses.

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

Klik untuk muat turun.

. 30 Dec 2018. Official PCB Calculator from LHDN Hasil. Removed YA2017 tax comparison.

Menuntut Daripada Orang Yang Meninggalkan Malaysia kini boleh didapati di Portal Rasmi HASiL untuk dimuat turun. On the First 5000 Next 15000. Updated PCB calculator for YA2019.

Better grab the opportunity while you still can as this is. 30 Dec 2018. Msian YouTuber Celebrates Over RM600000 In Earnings From Past 7 Years Creating ContentA 26-year-old Malaysian content creator just celebrated earning over RM600000 in revenue from playing video games and posting his content on social media over the past seven yearsMohd Rezza Rosly better known online as Rezzadude recently told Harian Metro in an.

W-01A-275-042018 Case Report Tax Appeal before the Special Commissioners of Income Tax. Muhammad Shafee is also charged with two counts of engaging in transactions resulting from illegal activities namely submitting incorrect tax returns which is in violation of paragraph 1131a. The income tax rate for resident individuals is reduced from 14 to 13 on taxable income in the range of RM50001 to RM70000 for the Year of Assessment ending 31 December 2021.

The LHDN explained that the global minimum tax was essential to. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Appointed to KLK Board on 20 December 1993.

The rental income is calculated on a net basis which means the final rental earnings amount is derived. Introduced PCB Schedule Mode where PCB amount will match LHDN PCB Schedule. To encourage Malaysian resident individuals to rent out residential homes at reasonable charges Malaysia budget 2018 announced that 50 income tax exemption be given on rental income received by Malaysian resident individuals in year of assessment 2018 subject to the following conditions.

Water analysis water quality pumping rate running cost- WTP - Liaise with contractor and consultant if any discrepancy. A recent tax case is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board of Malaysia. The Act would help outline the basic rights of landlords and tenants and could include.

- Manage tax related matter. Assessment year 2023 just do the same as previous step with your estimated 2022 total income but choose 2022 for PCB year. Updated PCB calculator for YA2019.

Kalkulator PCB - Lembaga Hasil Dalam Negeri. EIS is not included in tax relief. Taxpayers must apply for an income tax reference number at their local LHDN branch.

From the period of 112019 until 31122021 disposal in the sixth year after the date of acquisition of the chargeable asset is 5. On the First 5000. 8 EPF contribution removed.

Employment Insurance Scheme EIS deduction added. Superceded by the Public Ruling No. 102021 29122021 - Refer Year 2021.

While its Base Lending rate BLR will be revised from 640 pa. Employment Insurance Scheme EIS deduction added. - Manage tax related matter.

Calculations RM Rate TaxRM A. EPF tax relief limit revised to RM4000 per year. Tax Exemption On Rental Income From Residential Houses.

Child care fees to a Child Care Centre or a Kindergarten. Within one month after the date of payment to the non-resident remit the withholding tax to LHDN. Tax Treatment Of Research And Development Expenditure Part I Qualifying Research And Development Activity.

Dimaklumkan bahawa Ketetapan Umum No. Creating a tribunal to resolve disputes more cheaply and efficiently. - Handling external and internal audit on finance matter - Risk Management.

So when EPF members make a contribution or an additional contribution through the scheme they gain an. The GST was introduced in 2015 with a rate of 6 but it was replaced with the SST in 2018 by the Pakatan Harapan administration. Beginning 1 January 2018 rental income earned in Malaysia is evaluated on a progressive tax rate which ranges from 0 to 30.

Tax Treatment Of Research And Development Expenditure Part II Special Deductions. PR 122018 states that the rental. From the period of 112014 until 31122018 disposal in the sixth year after the date of acquisition of the chargeable asset is nil.

Maybank will reduce its Base Rate BR and Base Lending Rate BLR by 25 basis points effective Thursday 5 March 2020 in line with the reduction in the Overnight Policy Rate today. There is a maximum period of three 3 consecutive years of evaluation from 2018 to 2020. 8 EPF contribution removed.

Income Tax Act 1967 Withholding Tax Rate Payment Form. Introduced PCB Schedule Mode where PCB amount will match LHDN PCB Schedule. - Responsible for soil analysis water analysis water quality pumping rate running cost- WTP - Liaise with contractor and consultant if any.

Sections 107A 1a and 107A 1b 10 3. Tax Rate of Company. Dato Lee Hau Hian.

Maybanks Base Rate BR will be lowered from 275 pa. - Handling external and internal audit on finance matter. EIS is not included in tax relief.

To encourage Malaysian resident individuals to rent out residential homes at reasonable charges Malaysia budget 2018 announced that 50 income tax exemption be given on rental income received by Malaysian resident individuals in year of assessment 2018 subject to the following conditions. EPF tax relief limit revised to RM4000 per year. New income tax reliefs for YA 2021.

The Tenancy Agreement must be stamped by LHDN and put into effect by or after January 2018. The average EPF dividends rate for the past 10 years is 6185 with the lowest rate being 565 and the highest rate being 69. Removed YA2017 tax comparison.

Net saving in SSPNs scheme total deposit in year 2018 MINUS total withdrawal in year 2018 6000 Limited 11. Likewise if you need to estimate your yearly income tax for 2022 ie. Assist in counterparty risk assessment risk review and monitoring data management.

To protect the interests of both landlords and tenants in a fair way the recent Malaysia Budget 2018 proposed a Residential Rent Act to establish a more robust rental law in Malaysia. With LHDN announcement on 5th December 2018 WHT is to be computed on the gross amount paid to a non-resident.

New Irs Announces 2018 Tax Rates Standard Deductions Exemption Amounts And More

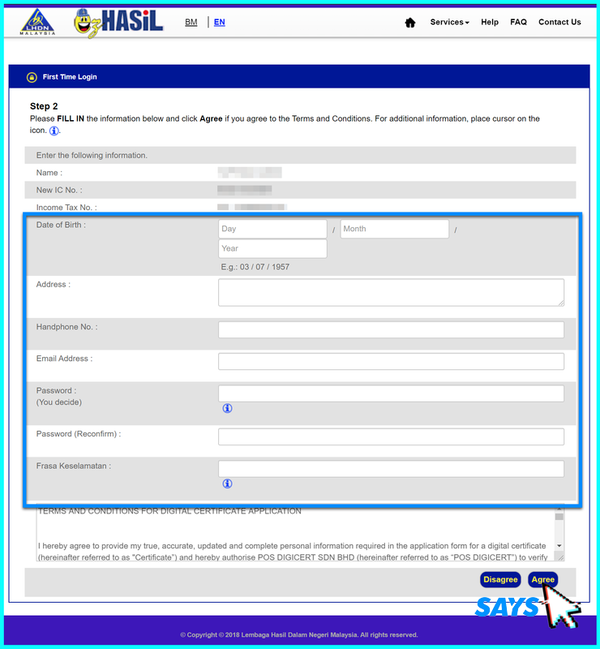

How To File Income Tax For The First Time

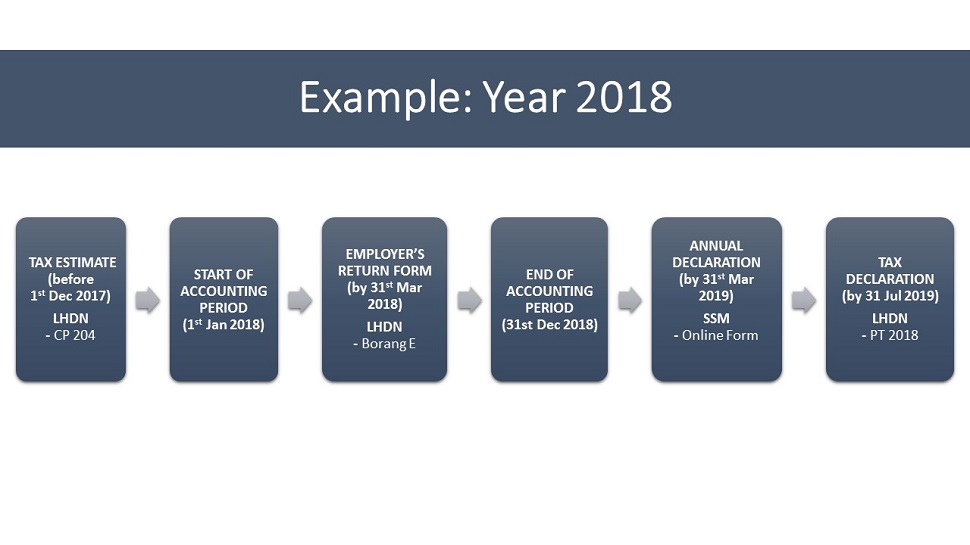

Mlf Accounting Tax Services 税务不再怕 系列prepared By Mlf Accounting Tax Services Your One Stop Agency Facebook

Individual Income Tax In Malaysia For Expatriates

Best Guide To Maximise Your Malaysian Income Tax Relief 2021

Cukai Pendapatan How To File Income Tax In Malaysia

Tax Rate Lembaga Hasil Dalam Negeri Malaysia

Malaysia Personal Income Tax Rates 2022

Tax Rate Lembaga Hasil Dalam Negeri Malaysia

Best Guide To Maximise Your Malaysian Income Tax Relief 2021

![]()

Tax Rate Lembaga Hasil Dalam Negeri Malaysia

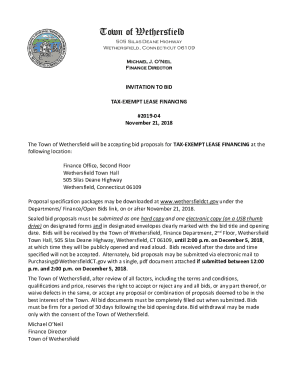

Fillable Online 2019 04 Tax Exempt Lease Financing Fax Email Print Pdffiller

How To Read A 2018 Income Tax Table 5 Things To Know Credit Karma

Budget 2019 The Proposed Tax Changes That The Business Must Know Cheng Co Group

Simple Pcb Calculator Malaysia On The App Store

The Ultimate Guide For Running A New Llp In Malaysia Mr Stingy

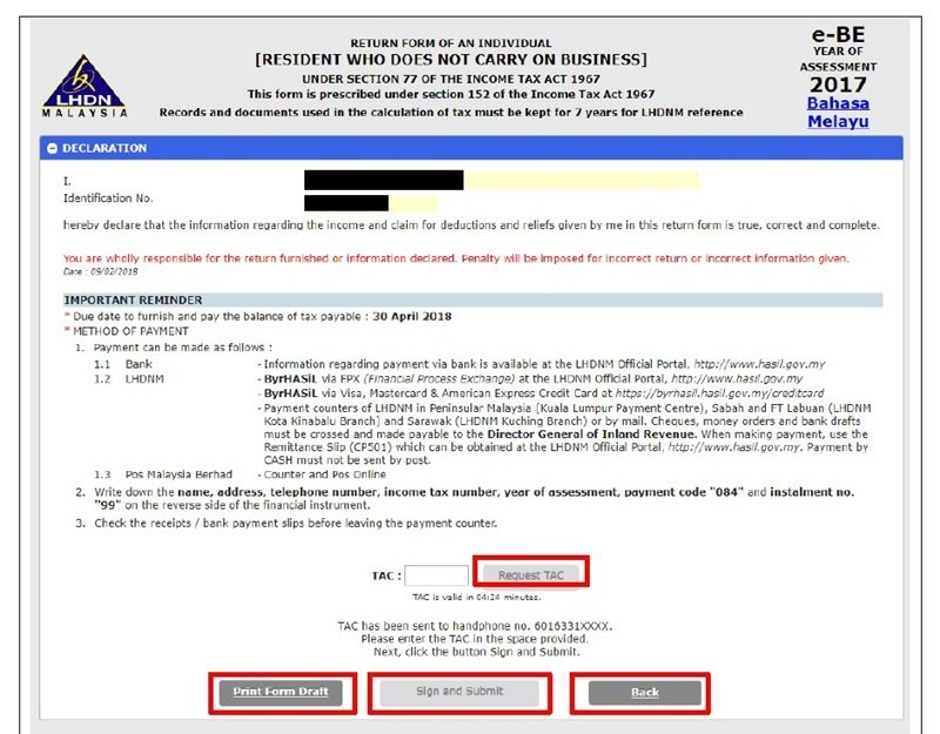

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Malaysia Personal Income Tax Guide 2020 Ya 2019

0 Response to "lhdn 2018 tax rate"

Post a Comment